Over the last 12 months, the cost of attending Clark University has risen and outpaced inflation, undergraduate student workers have called for a union, and the Provost has floated the idea of eliminating and/or restructuring some academic departments. With all of this going on, it should be no surprise that Clark University’s financial status has been a vibrant topic of conversation amongst the student body. Thankfully, there are objective and accessible sources of information to examine the fiscal operations of the University.

Like all 501(c)(3) not-for-profit corporations, Clark University is required by law to submit tax forms to the Internal Revenue Service (IRS) every year. These forms detail the financial activities of the University so that it may retain its tax-exempt status. Among these forms is Form 990, published on the IRS website for the public to review.

Additionally, since Clark University spends more than $1,000,000 in federal grants every year, the University must comply with an annual independent audit to ensure those grants are distributed correctly. The completed audits can be accessed most easily through ProPublica’s Nonprofit Explorer website.

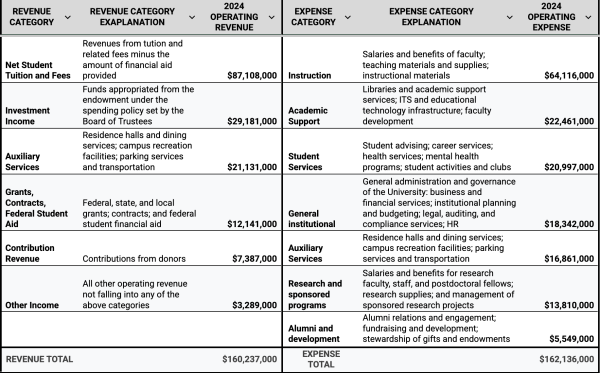

Based on the most recent federally mandated audit (May 2023-May 2024), the major sources of revenue and expenses for Clark University are as follows:

Another important facet of the University’s financial standing are its debts. The University issued $155,200,000 worth of bonds in 2021. These bonds are essentially a loan for the University, with fixed interest rates between 2.1613% and 3.316% depending on their date of maturity. Most of the bonds do not mature until the 2040s and 2050s. $55,200,000 of the proceeds from these bonds were used to refinance existing debt, thereby pushing back the date it will have to be paid back in full. The remaining $100,000,000 was earmarked for “capital projects” including “renovations and capital maintenance of existing facilities and the new Interactive Media Arts, Computing, and Design Building.”

Since the construction of MACD and the repairs to Goddard Library were financed with debt, those expenses are reflected in Form 990 but not in the audits.

Despite these technical details, the overall outline of the University’s fiscal position is apparent. The University did not turn a profit last year despite increases in tuition and cost-cutting measures. This can largely be explained by the publicly accessible audits released in the years 2018 through 2024. In 2018, operating costs were $110.7 million but had increased 46.4% to $162.1 million by 2024. This increase exceeds the baseline CPI inflation rate of 24.83% over the same period of time.

To maintain a balanced budget, revenues must also logically increase. As demonstrated by the May 2024 audit, there are few major sources of revenue to increase. Investment income is dependent on bond and stock market returns, federal grants are highly competitive, and there is a limit to how much funding can reasonably be raised from alumni and other donors.

Clark’s endowment, which at the time of the May 2024 audit was valued at $485,846,000, is sometimes pointed to as a way to improve the University’s finances. However, $393,636,000 of this money comes with donor restrictions, meaning that it can only legally be spent for specific purposes at specific times.

The $93,210,000 of endowment funds controlled directly by the Board of Trustees could be pulled from in an emergency, but doing so would permanently reduce the amount of future revenue because those funds would no longer be generating investment income. Therefore, removing funds from the endowment beyond a few percent a year would deteriorate the financial position of the University.

Issuing more bonds, as done in 2021, is also unlikely to provide long term relief. Companies are assessed on their ability to pay back their debt and are assigned a credit rating. A better credit rating is essential for businesses, non-profits, and governments to fund new projects and finance their existing debt at a low cost. Taking on more debt to pay for the everyday operation of the University would likely result in the University’s credit rating being downgraded and a greater portion of the University budget being used to service the debt. While there would be a short burst of income, the long term expenses of the University would rise in this scenario due to increasingly large debt payments.

With few other viable options, the financial burden of increased costs has largely been placed on students through the increases in tuition, room and board, and other fees. This is a serious concern for many students who are struggling to pay for college and had not budgeted for the total cost of attending Clark to be raised by thousands of dollars every year.

By law, the annual Form 990 reports and independent audits must remain accessible to the public, and by extension all Clark students. Although the documentation can be confusing and difficult to parse, it offers all Clark students the means to offer alternative methods of balancing the budget that lessen the financial burden on students.

If Clarkies desire to challenge convention and push for viable fiscal reform, diligent review of these documents will be invaluable.

The reports can be accessed using the following links:

https://projects.propublica.org/nonprofits/organizations/42111203